They say a picture is worth a thousand words. Below is a table describing the financial institutions considered “systemically important,” so called because their failure can imperil the financial system as a whole. For this reason, they are also known as global banks “too big to fail.” As shown below, these banks control an average of around half of all banking assets in some of the most advanced economies and China. The figures are drawn from a press release issued, on June 16, by the Bank for International Settlements, an organization dedicated to promote cooperation among the world’s central banks, headquartered in Basel, Switzerland.

Global Banks

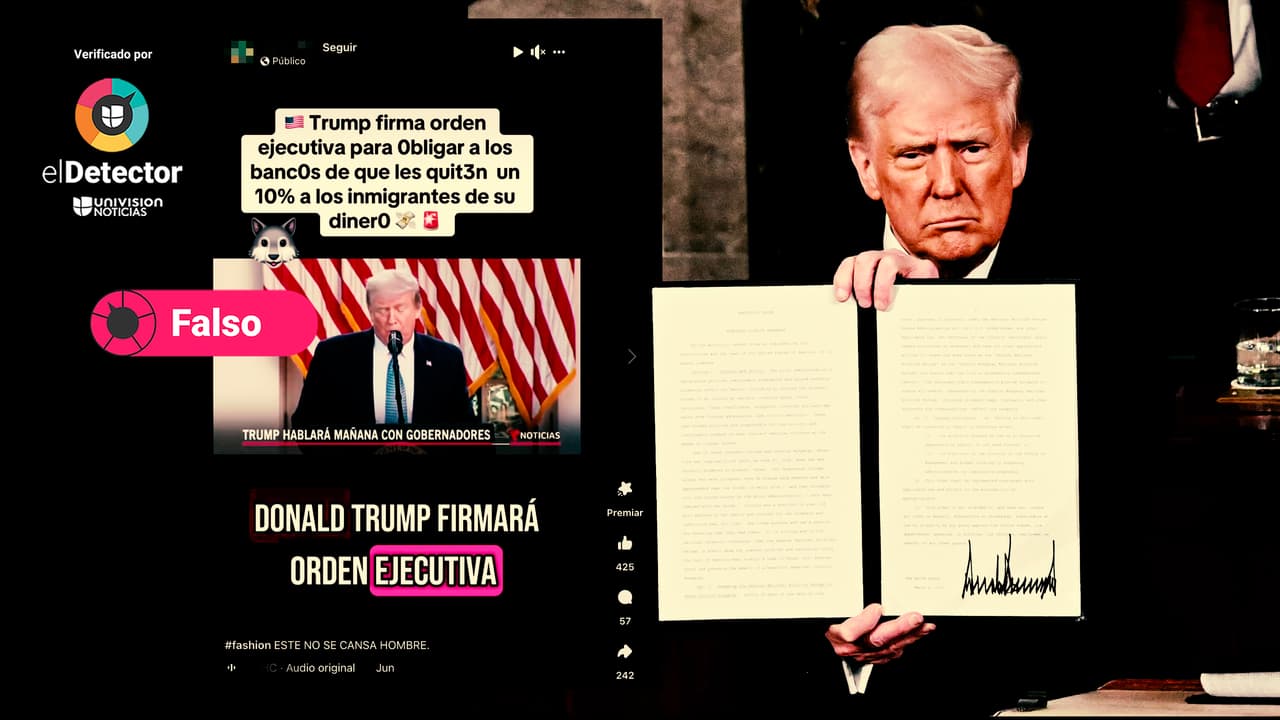

There are financial institutions considered ‘systemically important,’ so called because their failure can imperil the financial system as a whole. For this reason, they are also known as global banks ‘too big to fail.’

Bank of China in London. There are 250 foreign banks set up in the UK

Imagen Dan Kitwood/Getty Images

Disclaimer: We selected this Op-Ed to be published in our opinion section as a contribution to public debate. The views and opinions expressed in this column are those of its author(s) and/or the organization(s) they represent and do not reflect the views or the editorial line of Univision Noticias.

Relacionados: